UK Inflation - the Libyan threat.

It has been some forty-five years since I visited Benghazi. I was the third officer of a 16,000 ton tanker delivering aviation fuel to NATO air forces in Malta, Libya and Cyprus. The three navigating officers had agreed we would each have one port off-duty, being the junior I was allocated Benghazi. What seemed the short straw, turned out to be a delight. An early morning swim in the crystal clear, warm Mediterranean waters, a bit of sightseeing, gin and tonic followed by fine wine and a superb evening meal topped by an introduction to my first experience of the real art of arabian belly dancing, under scented blossoms and star-filled skies, still remain clear in my mind. I have since then always taken particular note of events in that country.

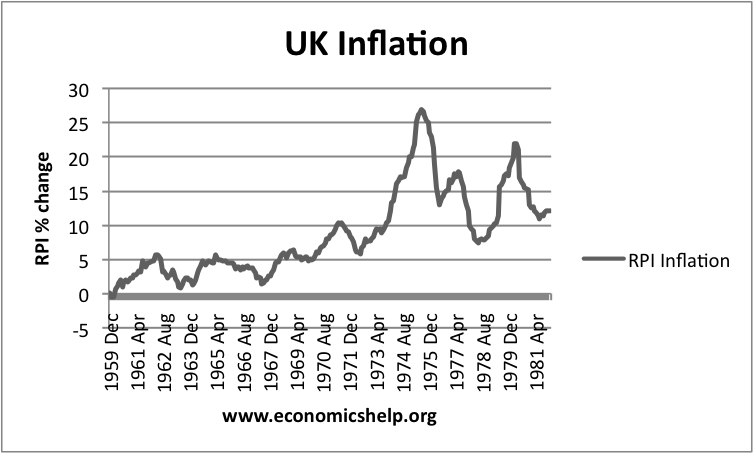

I have previously described on this blog, the events which led to the surge in inflation in the 1970s and 1980s, illustrated in the graph above. These posts, which destroy the myth that prosperity has ever been due to the EU or its forerunners, may be read from here for the post of November 2007, titled "Welcome to the world of $100 Oil and 'EU' be warned!" The second, more recently, in October 2010, is linked here, also discussed Sovereign Default and Ireland and concluded as follows:

Concurrently fixed price oil contracts could no longer be honoured at the new higher prices, sovereign oil producing states in the West who should have known better, such as the UK and Norway, enforced changes to their Oil Licence and Production Agreements to capitalize on the higher price, as they justified it, to share in the "windfall" profits.

Honesty in contract law became history in energy related industries (although resistance to renegotiating Charter Parties was fought for by some until the mid-nineteen-eighties) thus the seeds of the deep slump, for which Margaret Thatcher is still blamed by certain fools to this day, took root.

If Ireland proceeds to gain consent for changing the terms under which its banks foolishly borrowed money, there can be no calculating the consequences. Feeding greed never pays as can be seen, I believe, in the consequences of the events I describe above.

Labels: Ireland, Sovereign default, UK Inflation

0 Comments:

Post a Comment

<< Home